Empower your CIO role with transparent and well-structured cost allocation rules

CIO´s IT financial challenges

As a CIO, you know the importance of having a transparent and robust IT financial cost allocation rules in place to ensure the efficiency and effectiveness of your organization’s IT department.

A well-structured IT financial data model presents a clear and understandable picture of costs, identifies areas of cost optimization, and demonstrates the value and impact of your previous investments, which enhances your credibility as a CIO and reinforces trust with stakeholders.

However, many IT financial reports are unclear, which can make it challenging to present a clear picture of costs and identify areas for optimizing IT spending. There are three common reasons why CIOs may experience these difficulties.

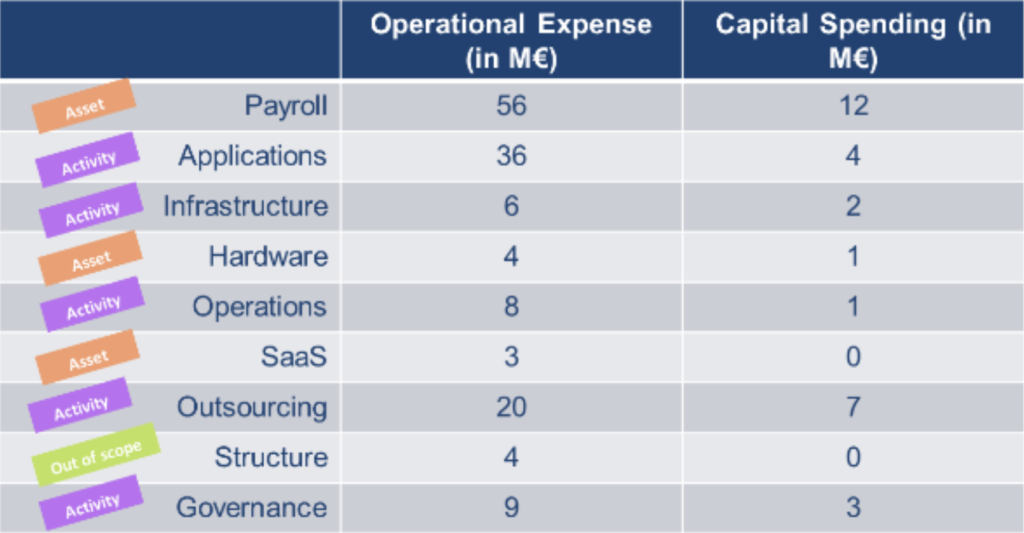

Firstly, reports may mix different types of financial data, including information related to the assets needed to manage IT activities, as well as data related to the activities themselves, making it difficult to gain a clear and comprehensive understanding of IT costs.

Secondly, your IT financial reporting may be managed with a narrow focus, based on traditional financial reporting methods. This can limit your ability to respond to the needs and questions of business and executive stakeholders.

Thirdly, you are using too complex cost allocation rules.

Creating multiple views

These factors can prevent stakeholders from fully understanding the costs and value of IT, and can make it challenging to make informed investment decisions.

To address these challenges, you should rethink your IT financial reporting and align it with best practices by creating create multiple perspectives of your financial information. Each perspective should meet the needs of different stakeholders. You should have one view by stakeholder profile, and each view should be built using best practices in financial reporting to benefit from the collective wisdom of peers and benchmark performance against them, helping to identify areas of strength and opportunities for improvement.

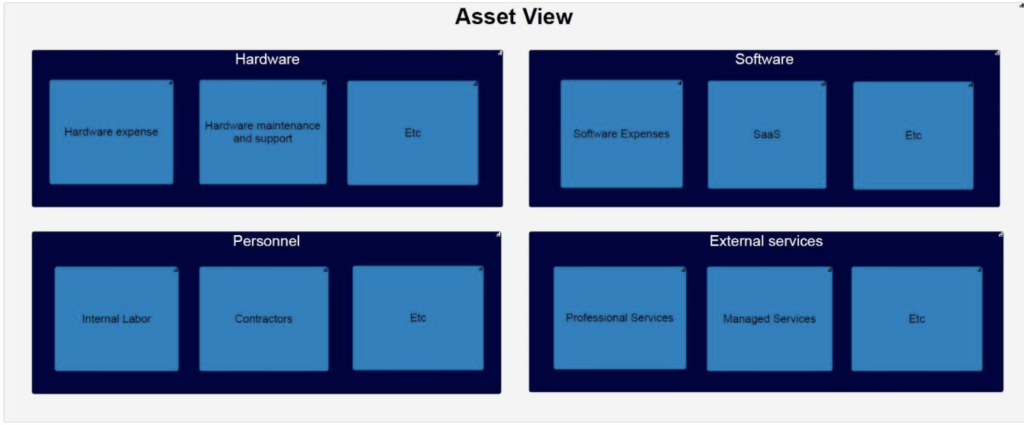

The Asset view

The first view of IT financial reporting, called the Asset view, should allocate IT investments and expenses to the four main assets: hardware, software, people, and external services. This view helps to understand which assets are necessary for the IT department to carry out its activities and create value. This view also provides finance stakeholders with a high-level overview of IT spending and investments, allowing them to understand how these costs align with the organization’s overall financial reporting.

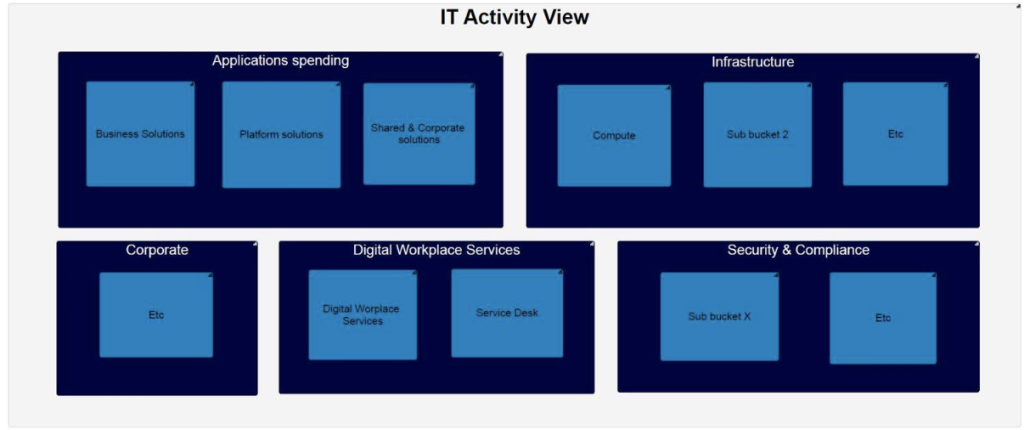

The Activity view

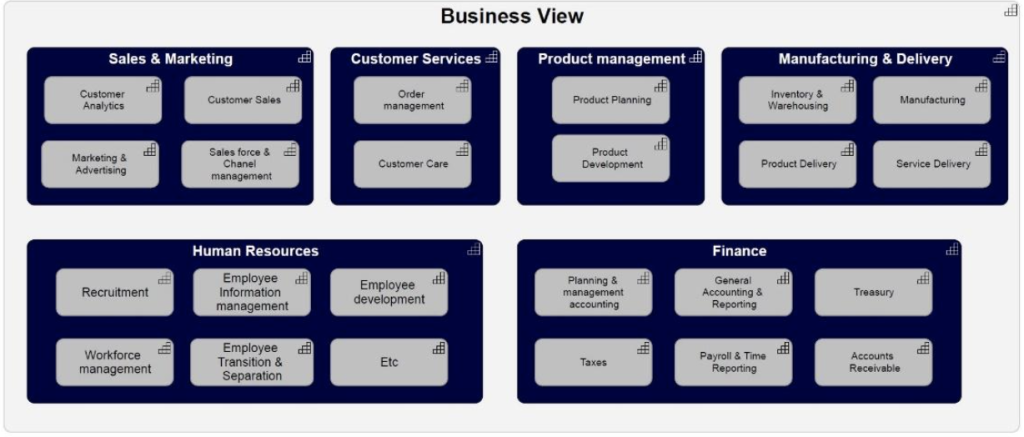

The Business view

Additional views

Effortless IT financial excellence

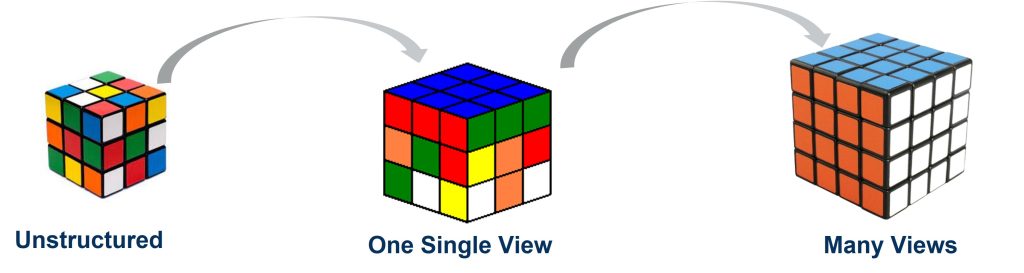

To build these different views of IT financial reporting, you will need to define and implement a tagging system that allows you to allocate expenses and investments to the different categories and activities described above. This may involve the development of cost allocation rules for each of the categories and activities. Building these views is similar to solving a Rubik’s cube, as you must use specific algorithms to ensure that the information presented in each view is accurate and consistent.

Adhering to best practices in financial reporting is an effortless activity that will bring a lot of value to your organization.