Implementing a Service-Based costing model for transparent IT Costing and stakeholder understanding

IT costing transparency

Transparency in IT costing is critical to ensure that an organization’s IT costs are visible, understandable, and easily accessible to relevant stakeholders. IT costs must be presented in a clear, accurate, and understandable way so that stakeholders can make informed decisions based on data. This transparency enables businesses to understand the true costs of IT for each service or business unit and make informed decisions about IT investments and optimization.

Adopting a service-based or activity-based costing model is a useful way to achieve this transparency.

Service-based costing model

A service-based costing model is a method of cost accounting that assigns costs to specific services that the business values. It involves identifying the different services provided by an organization, determining the cost drivers associated with each service, and allocating the costs of those drivers to each service or activity based on their usage. However, assigning costs to services can be complex in IT, as many resources are shared among multiple services.

Allocating IT costs to Business services

To align IT costs to services, it’s important to have a well-defined methodology for assigning costs and a clear service catalog that lists the services that the business values and consumes.

Two cost allocation models can be used to assign costs to services, each with its respective advantages and disadvantages.

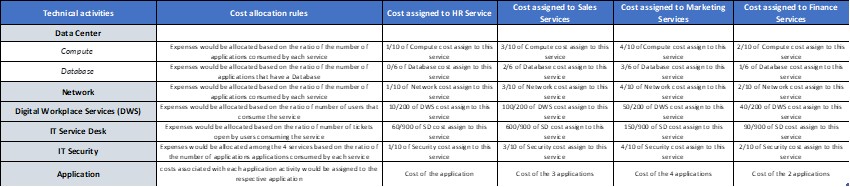

Model 1: Cost allocation rule assigned from the Technical View activities

This method involves allocating costs from the technical view to the business view. Shared IT activity expenses, such as security or governance activity, can be assigned to the services based on high ratios such as the number of applications or employees. The costs of the application activity costs can be assigned by the consumption of assets they use (personnel, software, hardware, services).

For example, suppose a company has four services: Sales, Marketing, Finance, and HR, and ten applications. Three of these applications are used by Sales, four are used by Marketing, two are used by Finance, and one is used by HR. In this case, the shared IT expenses would be allocated among the ten applications based on the ratio of the number of applications consumed by each service. Then, the costs associated with each application activity would be assigned to the respective application and allocated to each service based on their usage.

This method strikes a good balance between accuracy and simplicity. It is relatively easy to implement and maintain, and provides a reasonable level of accuracy for cost allocation. However, this method may not always provide a completely accurate allocation of costs, especially if the applications being used by different business services have vastly different levels of IT activity.

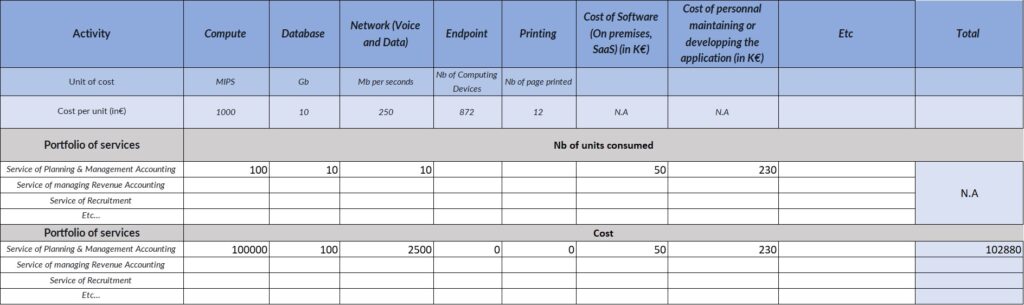

Model 2: Cost allocation rule assigned from the Asset View spend type

This method involves identifying each expense from the asset view, mapping it to the relevant application used by the business, and then assigning the cost to the services that the business values. If the asset is used by multiple applications, then you will need to identify the different cost drivers associated with this asset and allocate costs based on those drivers. For example, the cost of a particular server could be allocated to the application that consumes the most CPU usage from the server. Continuing with the previous example, instead of using the number of applications consumed by each business service, this method would identify the specific cost drivers associated with each application, such as CPU usage, network traffic, or storage. The costs associated with each of these drivers would then be allocated to the application, and then to the service.

This method provides a more accurate allocation of costs, as it takes into account the specific drivers that are most relevant for each application and then each service. But this method can be more complex to implement and maintain, as it requires a detailed understanding of the cost drivers for each application and business service. It can also be more time-consuming and resource-intensive to collect and analyse the necessary data.